It’s easy for public officials to call themselves fiscal conservatives or claim that they’re closely watching tax dollar expenditures. It’s more difficult to actually keep the fiscal car from careening off the road.

Last year’s Middlesex Borough revaluation shifted more of the tax burden to commercial properties. If you were fortunate enough to see your home’s tax bill get reduced, you might have thought that for at least a few years, you’d actually be paying a bit less in real estate taxes.

That was apparently a pipedream. The temporary tax relief granted some homeowners is being wiped out. It only took a year. The social media skeptics were correct. Your new tax bills this August will verify that.

The Borough Council’s proposed budget is up for a public hearing and adoption on May 14. The Board of Education approved its 2024-25 budget on Wednesday, May 1.

The average Middlesex Borough home is assessed at $425,000. Each of the two budgets will raise the taxes on that home by about $200. Collectively, the tax increase will be $400, plus any increase caused by the Middlesex County budget.

That’s if your home is in the $425K range. If it’s assessed higher than that, you’ll be paying even more.

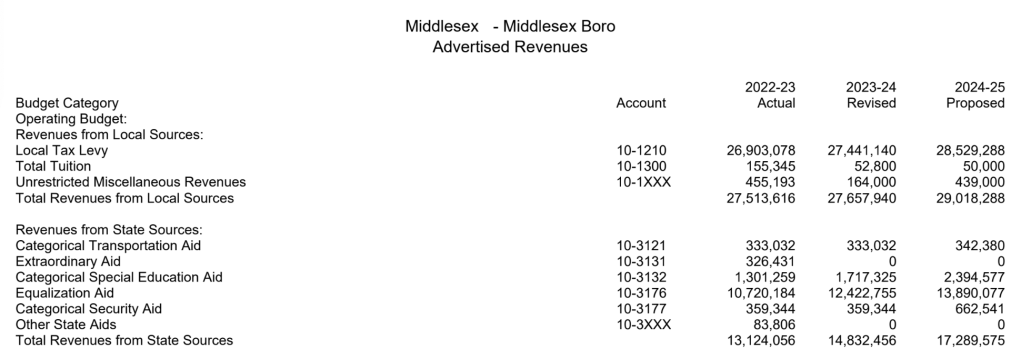

The tax levy to support the new school budget is up roughly 4%. That increase comes despite an anticipated total state aid increase to $17,289,575 from the $14,832,456 received during the current academic year.

It also comes at a time when the board is preparing to review a consultant’s demographic study, the potential first step in asking voters to approve a multi-million-dollar building improvement referendum at a future point.

The superintendent has gone on record as saying the district is running out of instructional space. The last time the board proposed a large-scale building referendum was in 2017. That $50 million plan was defeated by a 7-to-1 margin among participating voters.

The new school budget contains a series of staff hires, with the explanation for many of them given at the budget hearing. It remains to be seen if Middlesex Borough voters would look favorably on another referendum in a year or two, if they continue to pay 4% annual school tax increases.

The council’s new spending plan carries a 7.4% tax levy hike. That comes on top of a 7.5% rise last year, a whopping, roughly 15% tax increase since 2022.

A series of delayed police hires to replace retirees, plus the move to the Somerset County dispatch service, have been given as major reasons for the municipal increase. Lost on the mayor and council, apparently, is the concept of cutting in other areas to compensate.

Figures released by the council on the night of the budget introduction show that several other departments are hardly toeing the fiscal line. One line item labeled “administrator” is up 17.3%. “Roads department” is seeing an 11.8% increase. “Sewer department” is rising 20.15%. “Recreation department” is up 11.5%. “Buildings and grounds” is hiked nearly 12%.

The municipality is also absorbing certain increased expenses that are at least partly beyond its control. They include: worker’s comp (up 14.8%), Piscataway sewer service charge (up 34.6%) gasoline (increased 22.2%), Middlesex County Utility Authority (up 8.47%)

Public library spending, which is set by a formula in state statute, is increasing 11.9%.

It’s reasonable to wonder if there could be more restraint with the controllable increases. Year 1 of the two-year tax hit came as Republicans had no opposition for council seats or the mayoralty that were up for election. In 2024, Year 2 of the tax squeeze, the GOP appears to again be unopposed for a pair of council seats.

Hard to envision a 15%, two-year tax increase being imposed if Middlesex Borough Republicans faced Democratic opposition at the polls. That wouldn’t play well during an election. The mayoralty and six council seats are all currently held by the GOP.

The mayor and council seem to see nothing out of whack with a tax levy that goes up 15% in two years. It’s hard to decide what’s more alarming, the 15% increase or the belief that it’s perfectly acceptable?

The average home gets a $400 tax increase. An expensive school referendum might be on the way. Meanwhile, the two-year municipal tax rise is far above the typical raises constituents are receiving from their employers.

It’s fair for Middlesex Borough taxpayers to ask, “Who’s looking out for us?”

Reminder

Subscribe to Inside – Middlesex. Enter your email address to subscribe to this blog and receive notifications of new posts by email. It is absolutely free.

Visit Inside – Middlesex on our new Facebook page.

Leave a comment