In what is becoming a fairly regular tutorial at Middlesex Borough Council meetings, an official again took time to explain the consequences – or lack of them – from increased property assessments.

Tax Assessor Dawn Guttschall answered questions at the council’s Tuesday, Feb. 25 meeting. About 50 people attended at least part of the two-hour discussion. Roughly a dozen asked Guttschall questions.

The assessor’s presentation was the second in roughly five months. It was geared at calming property owners’ concerns from a new five-year, cyclical reassessment program.

Guttschall’s previous presentation was last September, after notification cards went out to the first 20% of borough property owners that were eyed for on-site inspections last fall under the reassessment.

This week she was back, not long after those same property owners and others received cards in the mail notifying them of their new assessed values. Properties not in the initial inspection group were adjusted based on market trends and sales of comparable homes.

Some of the assessor’s questioners asked about aspects of their own assessments. Overall, Guttschall had to quell fears that a sizeable property valiue increase translates directly into a huge tax bill hike. The primary factor in tax increases, she noted, is the amount of spending included in the municipal and Board of Education budgets.

“You don’t gain revenue by increasing people’s assessments,” Guttschall said. Assessments, she added, determine “how the pie gets cut up” or everyone’s portion of needed government revenue.

“It doesn’t matter what I assess you,” she told audience members. “The only way taxes will go down is if (governing bodies) spend less money.”

Guttschall acknowledged that the municipality’s effort to make property values current with the market comes during a local real estate boom.

“We are in a very big upswing,” she said of local property values, adding “they are not tailing off yet.”

Guttschall said Middlesex Borough’s tax base has increased 12% in 2025 over last year. Within that total, residential properties went up 14% collectively, while commercial properties rose at a lower rate of 6%.

Some audience members questioned why the cyclical reassessment was begun so quickly on the heels of the revaluation, which was conducted in 2022. Reval values became official the following year.

According to Guttschall, law allows for only a one-year gap after a revaluation, if a municipality desires to engage in a cyclical reassessment. Officials saw the five-year program as preferable to another revaluation down the road.

The five-year reassessment program keeps property values reflective of the real estate market and is less expensive than a revaluation. The 2022 reval cost about $300,000. The cyclical reassessment’s price is $30,000 to $35,000 annually, officials said.

Prior to 2022, the borough had not conducted a revaluation since 1986. The reval three years ago was ordered by Middlesex County because of the disparity between local property values and the real estate market.

Property visits conducted by inspectors were one part of the reassessment process. After a visit verified a home’s interior aspects, Guttschall said, sales of comparable properties were analyzed to set a given home’s value.

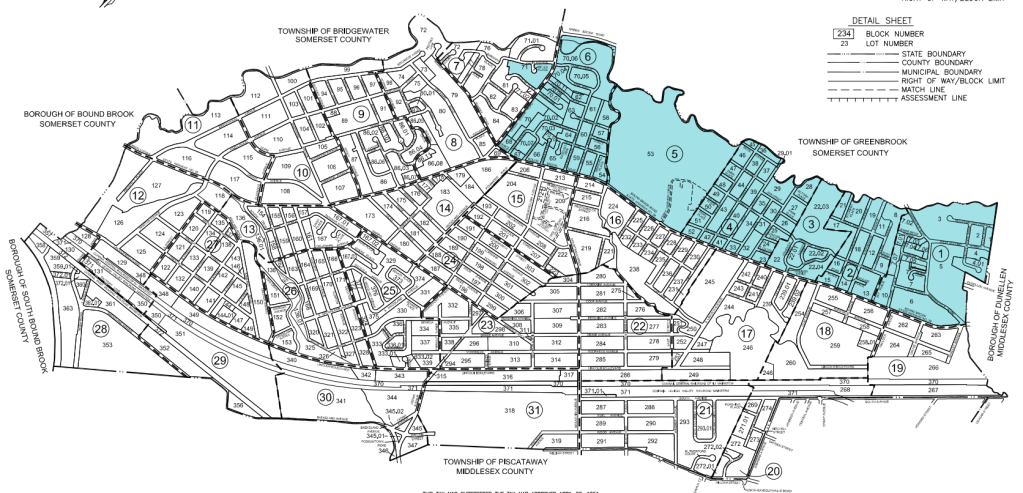

The reassessment’s first 20% cycle last fall sought to inspect 1,000 properties near the border with Green Brook. Guttschall said access was gained to about 65% of them. The 2022 reval gained access to about half of the properties in Middlesex. By law, property owners do not have to grant access to inspectors hired by a municipality.

Guttschall said homeowners who believe their assessment is excessive can meet with her to seek an adjustment. If still dissatisfied, the next option would be to appeal to the Middlesex County Board of Taxation. Doing so, she cautioned, would involve the homeowner compiling comparable sales to show a downward adjustment is warranted.

Reminder

Subscribe to Inside – Middlesex. Enter your email address to subscribe to this blog and receive notifications of new posts by email. It is absolutely free.

Visit Inside – Middlesex on our new Facebook page.

Leave a comment