Despite municipal and school tax levy hikes that each came in under 3%, many Middlesex Borough homeowners got an eye-opening jolt last week when property tax bills arrived in their mailbox.

The new bills cover the third and fourth quarters of 2025 and the first two quarters of 2026. Taxpayers were charged for the first two quarters of this year in bills received last summer.

All told, some property owners saw the amount owed increase much more than 3% for the year, experiencing hikes higher than $1,000 from calendar 2024. Those increases occurred even though municipal officials stressed there was stringent cost-cutting while preparing the 2025 budget.

While some need to dig deeper into their wallet to pay the taxman, a lesser number of homeowners saw decreases in their bill. For industrial and commercial property holders, reductions tended to be the trend in the new bills.

A major factor in determining homeowners’ differing tax fates was whether their property’s value has increased at a faster rate than others. All residential properties also carried the burden of compensating for lost tax revenue from decreased commercial and industrial values.

Mayor Jack Mikolajczyk said he’s already felt the wrath of taxpayers who suffered increases and then left him angry phone messages. “I got a couple of doozies,” the mayor said in a Monday, July 28 interview.

Mikolajczyk said various factors influence an individual tax bill, including comparable sales. He noted that in some neighborhoods, less expensive Middlesex homes are appreciating at a faster rate than higher valued residences. In turn, that spurred higher increases.

In the wake of the 2022 revaluation, more than 50 tax appeals were filed in State Tax Court by commercial property owners. Tax Assessor Dawn Guttschall said last year that those who received reductions through the appeal process would be given future tax credits to avoid an immediate borough payout.

Guttschall downplayed the eventual effect on other taxpayers when asked about the appeals at a Borough Council meeting. Mikolajczyk, however, did not discount that the credits are contributing to 2025 increases.

“It all factors in there,” the mayor said. He advised anyone wth questions or concerns about their bill to contact Guttschall.

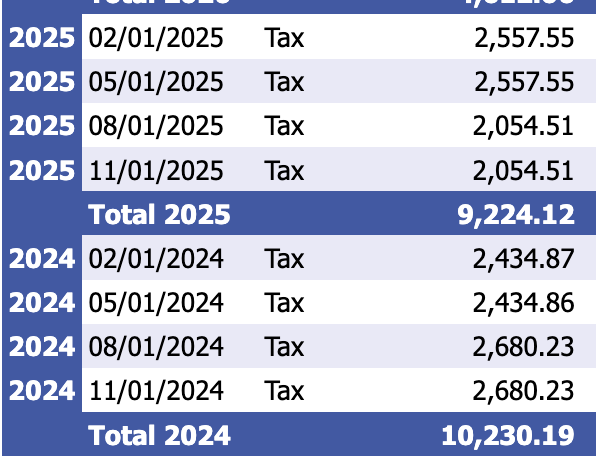

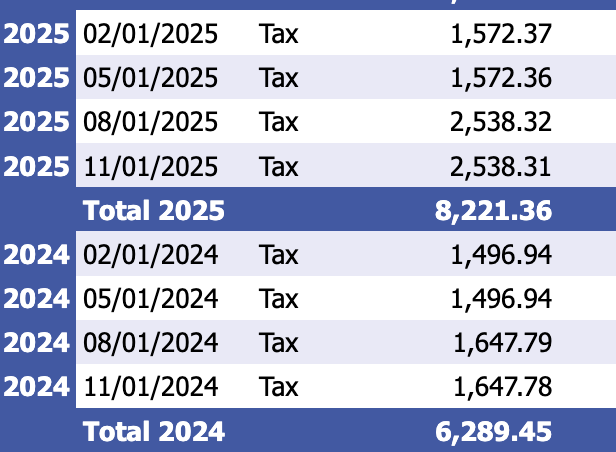

Inside – Middlesex reviewed the online tax bills of 75 residential properties, 25 classified as commercial, and 25 industrial tracts. The tracts in the sampling were selected at random. An attempt was made with the residential properties to represent neighborhoods throughout the borough.

The I-M review found the following:

- Of the 75 residential properties, 57 will pay more in 2025 taxes than they did last year and 18 will pay less. Twenty of those paying more are seeing increases of $1,000 or more. One residential property is seeing an increase of more than $2,800. Seven of those paying less are receiving reductions of at least $1,000. Two homes were found that are receiving tax decreases greater than $2,000.

- Twenty-two of 25 industrial sites will pay less taxes this year. Collectively, the borough will receive nearly $60,000 less in tax revenue from just those 25 properties. The largest commercial reduction in the sampling totaled $12,778 for 172-175 Baekeland Ave. That property includes Hikae Infotech, which was scrutinized earlier this year for environmental issues.

- Fourteen of the commercial sites will pay higher tax bills and 11 will pay less. But among the increases, seven are minimal, equaling less than 1% more than the 2024 bill. The two lots that comprise the Presidential Plaza office building on Bound Brook Road have had their combined tax total reduced by nearly $16,000. It appears some of that reduction involves past tax credits.

The increased tax pressure being felt by homeowners suggests that additional revenue sources should be found, according to Mikolajczyk. “We need development,” he said.

One option, he said, might be to consider using eminent domain to spur redevelopment of depressed commercial and industrial sites.

Eminent domain is the governmental power to take private property for public use, even if its owner does not want to sell. It comes with the requirement that the owner be justly compensated for the fair market value of the property.

Mikolajczyk mentioned the former Burger Tubing property on Lincoln Boulevard as one possibility. That former manufacturing site has been vacant for many years and has environmental issues that a redeveloper would need to address.

Reminder

Subscribe to Inside – Middlesex. Enter your email address to subscribe to this blog and receive notifications of new posts by email. It is absolutely free.

Visit Inside – Middlesex on our Facebook page.

Leave a comment