Middlesex Borough’s industrial and commercial properties are in decline, the speaker told those gathered in the municipal courtroom, and he cautioned about the potential fallout for residential taxpayers.

“The businesses that were in those buildings simply aren’t there any more,” he said. “The need for redevelopment is very, very important especially after a tax revaluation.”

The borough needs to seek new development and growth, the speaker added, “so we can offset those losses and bring those ratables back into the base.”

That pitch for new ratables wasn’t given recently by the current mayor and Borough Council, although it does reflect 2025 reality.

The speaker was then-Mayor Ron DiMura, during a town hall he convened in March 2017 to discuss the revaluation, redevelopment and PILOT (Payment in Lieu of Taxes) agreements.

Not everything DiMura said that evening was spot on. He overstated the amount of PILOT revenue that would be forthcoming from The Lofts. He said Lofts payments would start flowing into municipal coffers later in 2017. The collection got delayed because the tax office was not notified after a certificate of occupancy was issued.

DiMura also forgot to mention that a redeveloper had made campaign donations the prior year into accounts he was unlawfully pilfering. But his forecast of depreciated industrial and commercial property values after the reval and spillover effects for others turned out to be correct, although it took a few years to play out.

The revaluation was ordered by state and county tax officials during DiMura’s tenure, but got delayed until after his departure. The borough was given time to amass the funds needed to pay for the exercise and then the covid pandemic intervened.

The reval was conducted in 2022 with new property values going into effect the following year. Borough officials stated then that a greater share of the tax burden would be carried by commercial properties.

Perhaps municipal officials overplayed their hand. More than 50 commercial property owners filed tax appeals with the state. At a public meeting last year, the tax assessor said tax credits were being given for reductions received by appellants, as opposed to direct refunds. Recently, Mayor Jack Mikolajczyk acknowledged that those credits are contributing to the tax burden on residential property owners in 2025.

Some homeowners living near the industrial zone are suffering a triple-whammy. They can be subjected to noise and/or odor disturbances from industrial properties. They’ve seen some of the offenders – or the owners of the properties where they sit – receive reduced tax bills due to decreased property value. In turn, they and other borough homeowners are forced to pay tax bills that compensate for depressed commercial and industrial assessments.

An online scan of industrial and commercial tax bills illustrates the extent of ratable loss in those property classes. Few industrial properties have seen their tax bills rise. Some commercial sites have increased, but they appear to be outpaced by those that have decreased.

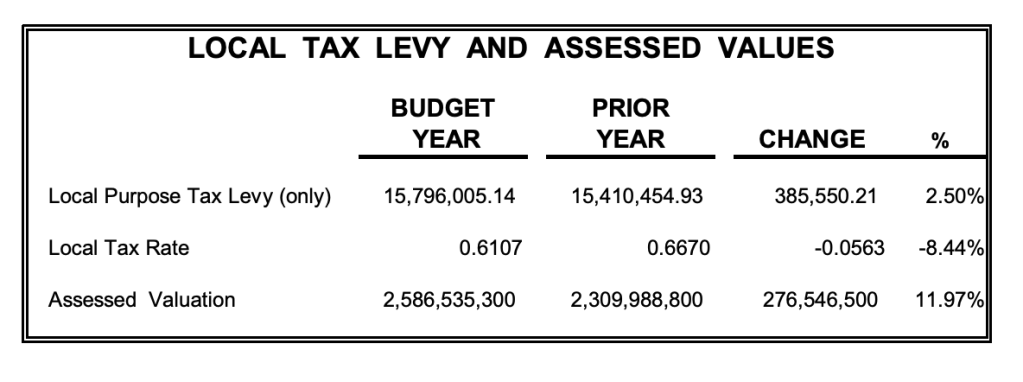

A table in the 2025 municipal budget states that collectively, the value of all real estate within Middlesex Borough has increased nearly 12% this year over last. With the drop in most industrial values and many commercial properties, that overall increase has been fueled largely by residential increases.

Tax bill examples. Yearly amounts were obtained from the borough web site:

- 109 Harris Ave. (commercial w/ Chief’s Steak Shop, The Don’s Barbershop and others) – decrease from $17,165 in 2024 to $15,726 this year, an 8.3% drop.

- 1272 Bound Brook Road (commercial – Wendy’s) – decrease from $9,915 last year to $9,516 in 2025, down 4%.

- 651 Bound Brook Road (commercial – Carpaccio) – drop from $22,121 in 2024 to $20,267 this year, down 8.3% from the $22,121.

- 1273 + 1275 Bound Brook Road (two lots comprising Presidential Plaza) – total 2024 tax bill of $69,557 reduced to $53,648 this year, which apparently includes credits. The difference equals 22.8%.

- 99 Lincoln Boulevard (7-11 convenience store) – $41,652 tax bill for 2024 increased to $41,976 this year, a 0.7% rise.

- 1212 Bound Brook Road (CVS/Rita’s) – $41,152 bill last year, upped to $41,471, a 0.7% increase.

- 172-176 Baekeland Ave. (includes Hikae Infotech) – $152,409 paid in 2024 reduced to $139,631 this year, an 8.3% decrease.

- 125 Factory Lane (Veolia) – $39,018 last year decreased to $35,747 in 2025, a drop of 8.3%

- 344 Cedar Ave. (Spray-Tek) $51.194 tax bill in 2024 increased to $51,592 this year, a rise of 0.7%.

There is no meaningful development or redevelopment occurring in Middlesex. The Joint Land Use Board met six times in the first six months of 2025, down from eight meetings in the first half of 2024. Only three applications were handled during those first six 2025 meetings.

None of the three proposed significant development. One involved a day care center expansion, another was a subdivision that will result in one new home’s construction. The other involved the review of a business that had acquired a borough-owned parcel.

Borough officials have appeared to walk a conflicted tightrope regarding development in recent years. During the final years of DiMura’s tenure, the community perception was that politically connected redevelopers could get any approvals they wanted.

After taking control of borough government seven years ago, Republicans stressed they would handle development differently. For a period of years, no new redevelopers have come calling. Now, the borough is looking for redevelopment partners to ease the tax burden on homeowners. If some are found, the question becomes how intensive their projects would be.

Mikolajczyk recently floated the idea of using eminent domain to spur the redevelopment of depressed properties. Eminent domain is the governmental power to take private property for public use, even if its owner does not want to sell. It comes with the requirement that the owner be justly compensated for the fair market value of the property.

The mayor mentioned the former Burger Tubing property on Lincoln Boulevard as a redevelopment candidate. The former manufacturing site has been closed for years and sits in a contaminated state, the subject of environmental monitoring due to a threat to surrounding groundwater.

In its depressed, contaminated state, the borough continues to lose revenue from the Burger site. Its owner, the Bound Brook-based Mission Baptist Church, paid $14,462 in 2024 property taxes. The bill has been reduced to $13,250 in 2025, a decrease of 8.3%.

Reminder

Subscribe to Inside – Middlesex. Enter your email address to subscribe to this blog and receive notifications of new posts by email. It is absolutely free.

Visit Inside – Middlesex on our Facebook page.

Leave a comment